Amazon continues to set the gold standard for online marketplaces, drawing more than 2.3 billion web visits each month and giving sellers access to one of the largest global customer bases in e-commerce.

With over 9.7 million registered Amazon sellers worldwide and nearly 1.9 million active sellers, the platform has never been more enticing for entrepreneurs, brands, and small businesses looking to boost revenue and brand reach.

Check out the latest Amazon Seller Statistics for 2026 to find out key trends, top-performing categories, business models, and insider tips.

Key Amazon Seller Statistics 2026: At a Glance

The Scale of the Amazon Marketplace

The sheer number of sellers on Amazon is a testament to its global dominance. While millions are registered, the number of active sellers provides a more accurate picture of the competitive environment.

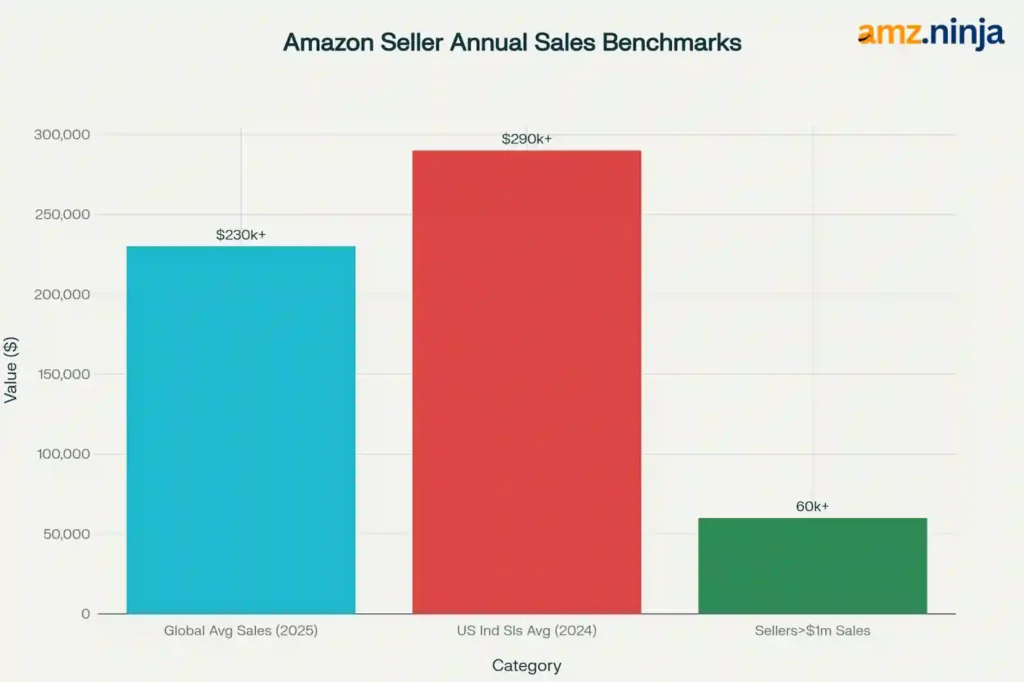

Amazon Seller Revenue and Profitability

The revenue potential on Amazon is substantial, with many sellers achieving significant financial success. However, profitability varies widely based on business models, product categories, and operational efficiency.

Monthly Sales and Profit Margins

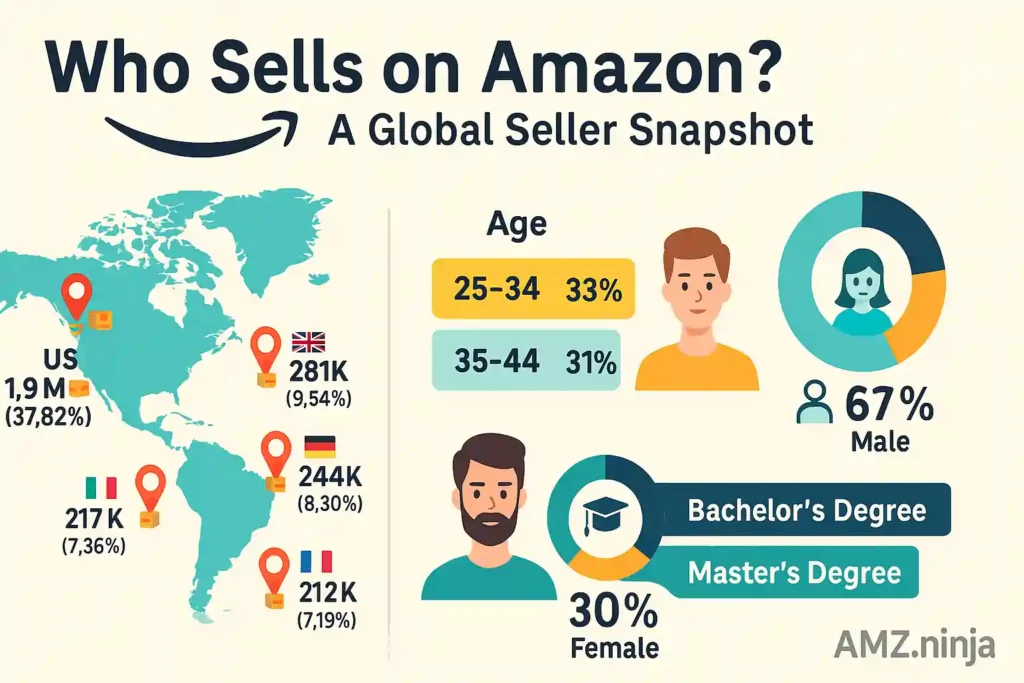

Amazon Seller Demographics

The community of Amazon sellers is diverse, spanning various age groups, educational backgrounds, and geographic locations.

Sellers by Country

The United States is home to the largest contingent of Amazon sellers, but the platform has a strong international presence.

Age, Gender, and Education

Younger, well-educated males dominate the seller landscape.

Business Models and Fulfillment Methods

Sellers on Amazon employ a variety of business models and fulfillment strategies to bring their products to market.

Popular Business Models

The private label model, where sellers create their own brand, is the most popular strategy.

| Business Model | Percentage of Sellers Using It |

|---|---|

| Private Label | 54% |

| Wholesale | 25% |

| Retail Arbitrage | 25% |

| Online Arbitrage | 21% |

| Dropshipping | 19% |

| Handmade | 9% |

Fulfillment by Amazon (FBA) vs. Fulfillment by Merchant (FBM)

Fulfillment by Amazon (FBA) is the overwhelmingly preferred method, allowing sellers to outsource storage, packing, and shipping to Amazon.

Top Product Categories

The “Home & Kitchen” category remains the most popular and profitable segment for Amazon sellers.

| Product Category | Percentage of Sellers | Year-over-Year Change |

|---|---|---|

| Home & Kitchen | 35% | +6% |

| Beauty & Personal Care | 26% | +4% |

| Clothing, Shoes & Jewelry | 20% | 0% |

| Toys & Games | 18% | +13% |

| Health, Household & Baby Care | 17% | 0% |

| Books | 14% | +17% |

A fun fact: During Prime Day, some of the most popular items purchased worldwide include Amazon's own devices like the Fire TV Stick, alongside everyday essentials like protein shakes.

Common Challenges for Sellers

Despite the opportunities, selling on Amazon is not without its hurdles. Competition, rising costs, and managing customer feedback are among the top concerns.

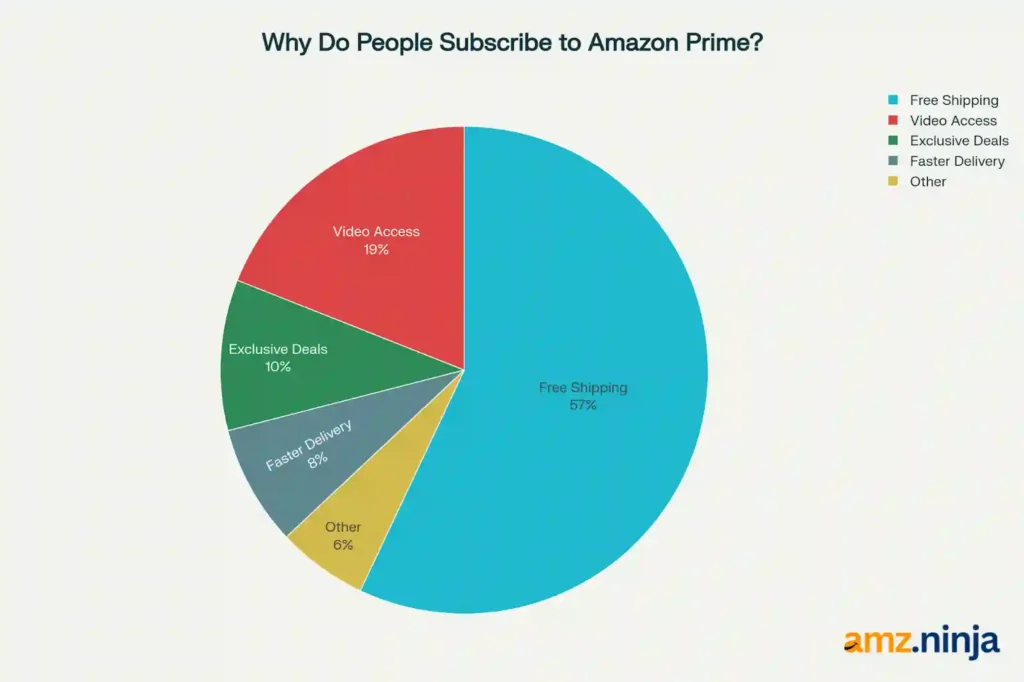

The Power of Amazon Prime

The Amazon Prime membership program is a massive driver of sales and customer loyalty.

- Amazon boasts over 200 million Prime members worldwide.

- In the US alone, there are approximately 180 million Prime subscribers, which accounts for 75% of the country's shoppers.

- The primary reason for subscribing to Prime is free shipping (57% of members)

- During Prime Day 2024, independent sellers sold more than 200 million items.

The Rise of AI for Amazon Sellers

Artificial intelligence is becoming an indispensable tool for sellers looking to gain a competitive edge.

Conclusion: Actionable Insights for Amazon Sellers in 2026

The latest Amazon seller statistics shine a light on the growing scale and complexity of the platform. Competition is fierce, but opportunity still abounds: new sellers continue to join by the thousands, and top earners are scaling profits with smart inventory, pricing, marketing, and technology choices.

Strategies that combine private label, efficient FBA logistics, competitive pricing, and AI-powered tools are driving the biggest wins.

Actionable Tips:

- Focus on product niches with lower competition and better margins (like Handmade or Industrial Supplies).

- Use FBA to save on shipping and improve Prime eligibility.

- Invest in SEO and paid ads, but watch costs and optimize campaigns regularly.

- Stay vigilant against counterfeiters, and register your brand for added security.

- Diversify sourcing and sales channels to build resilience.

With over 60% of sales coming from third-party sellers, Amazon marketplace is firmly in the hands of independent entrepreneurs. Keep up with the numbers, stay nimble, and the world’s top e-commerce marketplace remains a powerful force for your business growth in 2026 and beyond.