As the e-commerce boom continues, online sellers face mounting pressure to navigate the complex web of sales tax compliance. Failure to collect and remit the proper sales taxes can lead to costly audits and penalties.

According to Forbes, Global e-commerce sales are projected to skyrocket past $6.3 trillion by 2024. With this explosive growth, governments are cracking down on untapped sales tax revenue – estimated at a staggering $5 billion lost annually on low-value imported goods alone.

That's where TaxJar's free trial comes in, offering a seamless solution tailored for e-commerce businesses. This powerful sales tax automation platform handles the entire compliance lifecycle, from real-time rate calculations to filing returns across multiple states.

During the 30-day free trial, sellers gain full access to TaxJar's suite of professional tools. Import historical data, connect sales channels like Amazon and Shopify, and experience economic nexus insights to determine tax obligations. With transparent pricing and no credit card required, the free trial provides a risk-free way to simplify sales tax management.

As one seller raved, “TaxJar just does the job“ – could it be the solution you need?

Why Use TaxJar For Amazon Sales Tax?

Navigating sales tax compliance has become a nightmare for online sellers, with over 13,000 tax jurisdictions across the U.S. and economic nexus laws requiring out-of-state businesses to collect taxes.

That's where TaxJar's free trial comes in – offering a seamless solution to automate sales tax calculations, reporting, and filing.

In the post-Wayfair era, where 33 states collected $23 billion in remote sales tax in 2021 alone, can you afford to risk non-compliance?

With a powerful API that determines the accurate rates based on the buyer's address, TaxJar ensures you never underpay or overpay.

Key reasons Why TaxJar Is Hyped Up As An Excellent choice For Sellers:

- Multi-Channel Support: TaxJar integrates with popular e-commerce platforms like Amazon, Shopify, WooCommerce, and more, allowing you to manage sales tax from a single dashboard.

- Real-Time Rate Calculations: TaxJar's API automatically calculates sales tax rates at checkout based on the buyer's shipping address, ensuring accurate tax collection.

- Reporting and Filing: TaxJar generates detailed reports for all your sales tax data, making it easy to file returns in any state where you have nexus.

- Economic Nexus Tracking: Stay on top of your economic nexus obligations with TaxJar's nexus monitoring and alerts.

“TaxJar is reimagining how businesses manage sales tax compliance. Our cloud-based platform automates the entire sales tax life cycle across all of your sales channels — from calculations and nexus tracking to reporting and filing.”

– TaxJar

Steps To Get Started with TaxJar's Free 30-Day Trial

Step 1: Visit TaxJar.com

Head to the TaxJar website and click on the “Start a Free Trial” button.

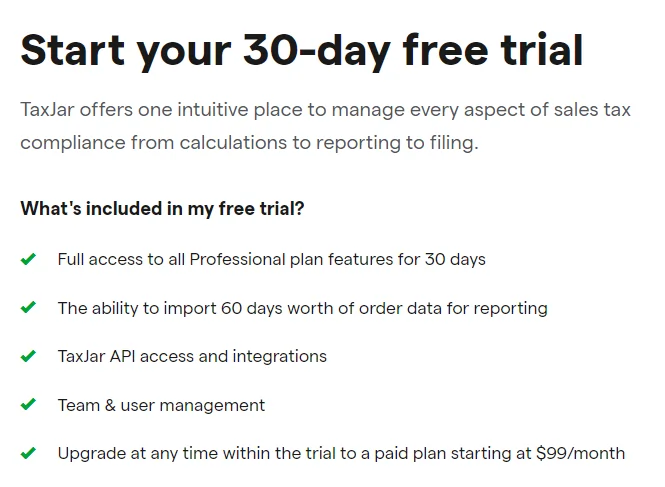

Step 2: Discover What's Included In Your 30-day Free Trial

TaxJar's 30-day free trial likely gives you full access to their sales tax automation platform for a limited period, allowing you to explore and test out the core features before committing to a paid subscription.

Step 3: Log In Or Create Account:

If you already have a TaxJar account, log in with your email and password. If not, you'll be prompted to create a new account.

OR

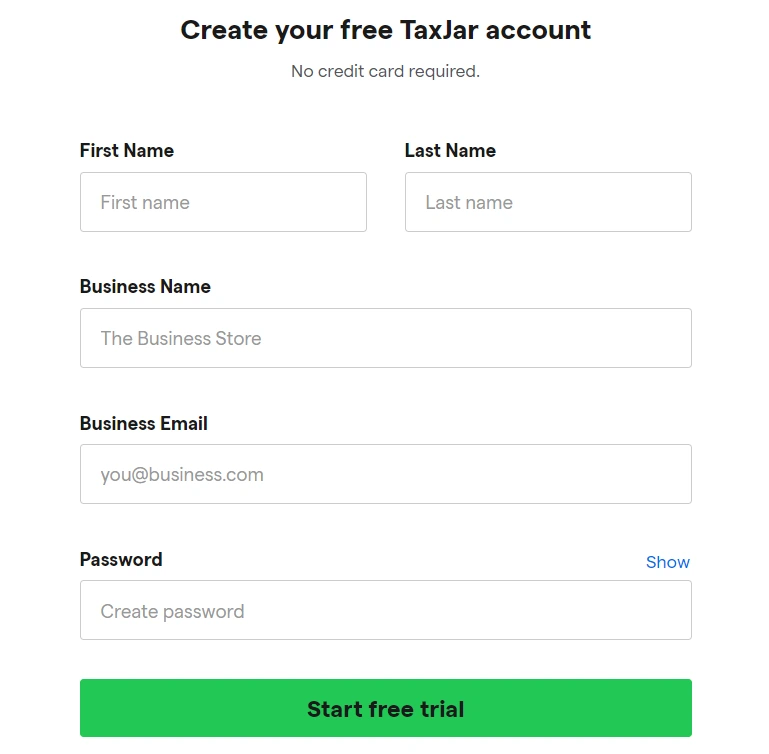

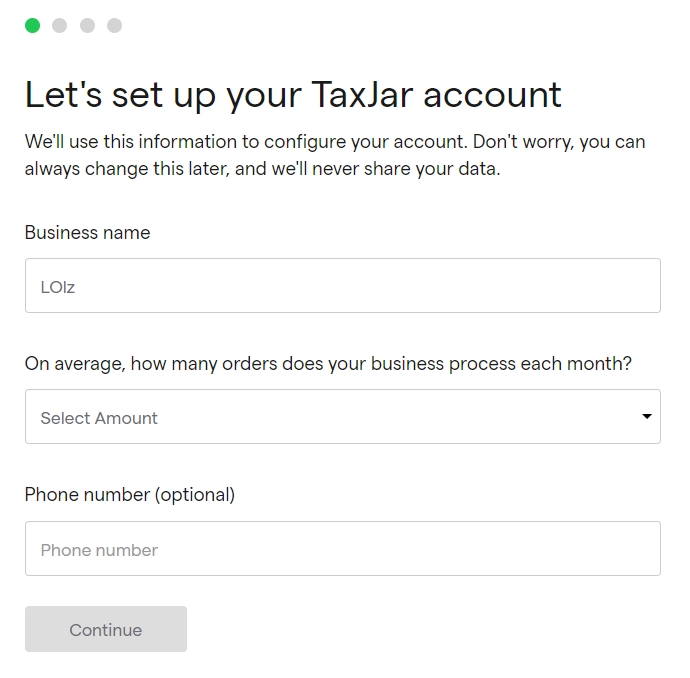

Step 4: Set Up Your TaxJar Account

Enter your business name (e.g., “LOLz” in the example), select the average number of orders your business processes each month, and optionally provide your phone number. Then click “Continue”.

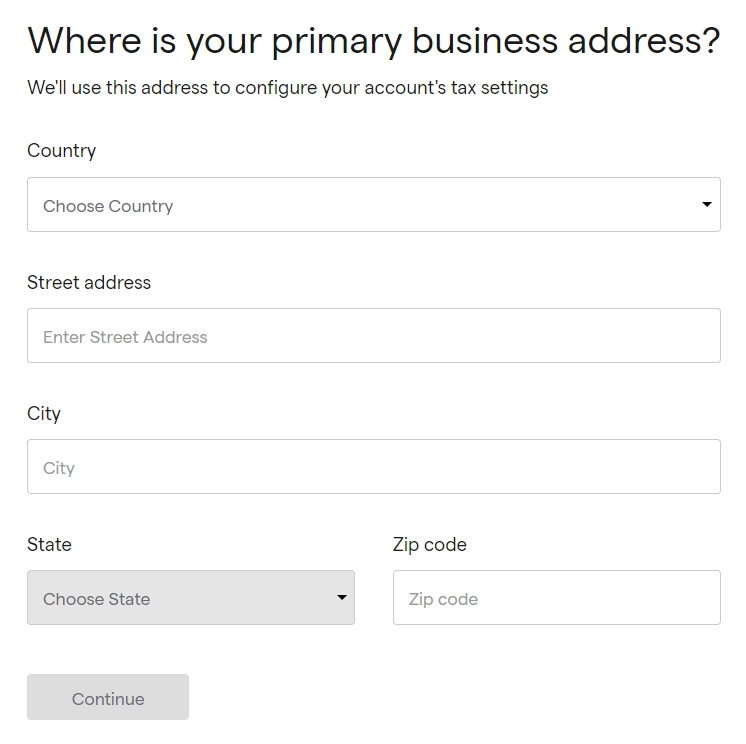

Step 5: Enter Your Business Address

Provide your primary business address, including country, street address, city, state, and zip code. TaxJar will use this information to configure your account's tax settings.

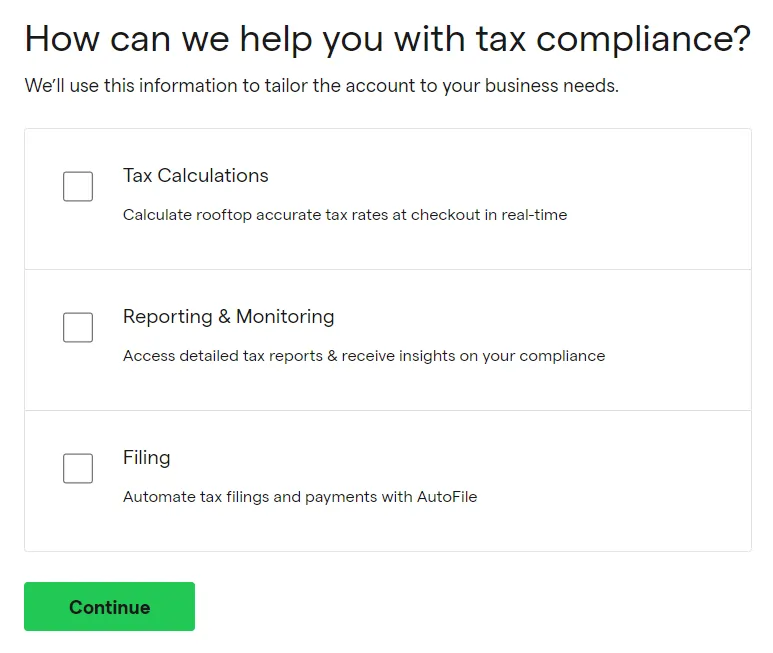

Step 6: Select Services

Choose the TaxJar services you need help with, such as Tax Calculations, Reporting & Monitoring, and Filing. Then click “Continue”.

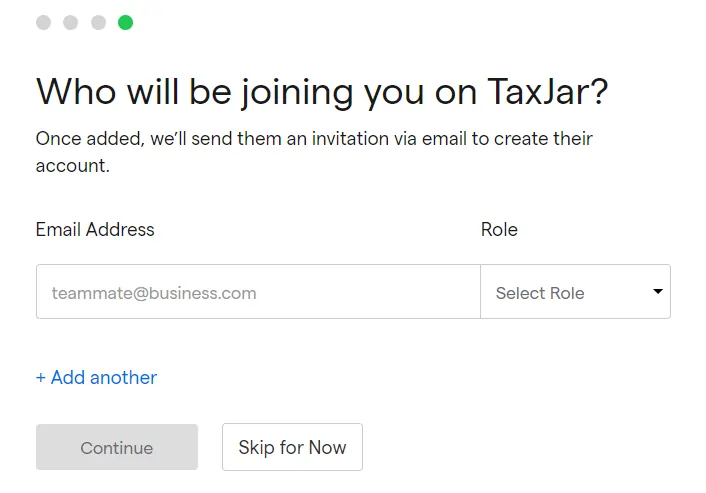

Step 6: Add Team Members (Optional)

On the next screen, you can choose to add teammates to your TaxJar account by entering their email addresses and selecting their roles. If you don't want to add anyone now, click “Skip for Now”.

Congratulations On Your TaxJar Free Trial enrollment!

Important Note: No credit card is required to start your TaxJar free trial. You can cancel at any time before the 30 days are up without being charged.

Making the Most of Your TaxJar Free Trial

While the free trial gives you complete access to TaxJar's features, there are a few key areas you'll want to focus on to get the most out of your trial experience:

- Sales Tax Calculations: Test out TaxJar's real-time sales tax rate calculations by making test orders on your Amazon store. Verify that the correct rates are being applied based on the buyer's shipping address.

- Reporting and Filing: Generate sample sales tax reports for your Amazon sales data. Familiarize yourself with the reporting interface and see how easy it is to file returns in your nexus states.

- Economic Nexus Monitoring: Explore TaxJar's economic nexus tracking tools. See how it monitors your sales data and alerts you when you're approaching or have established nexus in new states.

- Integrations and Automation: If you use multiple sales channels, test out TaxJar's integrations and see how it consolidates all your sales tax data into a single dashboard.

- Customer Support: Don't hesitate to reach out to TaxJar's customer support team during your trial. They can answer any questions you have and provide guidance on using the platform effectively.

Follow Regular Updates By TaxJar!

The official TaxJar Twitter account @TaxJar frequently tweets about sales tax due dates and reminds followers to sign up for their 30-day free trial.

During your free trial, be sure to explore TaxJar's economic nexus tracking tools, as it monitors your sales data and alerts you when you're approaching or have established nexus in new states.

What Are The Pricing Plans After Free Trial Ends?

Once your 30-day free trial ends, you'll need to choose a paid plan to continue using TaxJar. Here's a quick overview of their pricing structure:

| Plan | Monthly Price | Features |

|---|---|---|

| Starter | $19 + $0.25/order | Basic reporting, filing, exemption certificates |

| Professional | $99 + $0.15/order | Real-time calculations, nexus monitoring, advanced reporting |

| Premium | Custom pricing | For larger businesses with complex needs |

Example: If you're on the Professional plan and process 500 orders per month, your total cost would be $99 + (500 x $0.15) = $174 per month.

TaxJar's pricing is transparent, with no hidden fees or long-term contracts. You can easily upgrade, downgrade, or cancel your plan at any time.

Say Goodbye To Sales Tax Headaches With TaxJar

Don't let sales tax compliance issues hold your business back. TaxJar's free 30-day trial offers a risk-free way to experience the benefits of automated sales tax management. With real-time rate calculations, economic nexus monitoring, and streamlined reporting across all your sales channels, TaxJar simplifies a notoriously complex process.

TaxJar is a big help in freeing you to focus on growing your e-commerce operations. Proper compliance is critical, especially as the average monetary loss from e-commerce scams reached $101 per incident in 2022, up from $96 the previous year.

During the free trial, you'll have complete access to TaxJar's suite of professional tools like API integrations, product tax categorization, and team management capabilities.

No credit card is required, so you can explore the platform commitment-free. With transparent, order-based pricing starting at $99/month after the trial, TaxJar provides an affordable solution tailored to businesses of all sizes.

Take the first step towards hassle-free sales tax management today! Sign up for TaxJar's free trial and experience why over 20,000 online sellers trust this award-winning software.